4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

The EUR/USD currency pair on Thursday continued the growth started the day before. Is it worth reminding once again that yesterday and the day before yesterday were the days of the announcement of the results of the meetings of the ECB and the Fed? It was these events that were in the first place among traders. It was these events that influenced the movement of the euro/dollar pair. However, not everything is so simple. In yesterday's article, we deliberately did not consider the movement immediately after the announcement of the results of the meeting. And, as it turned out later, they did the right thing, because already at night, the US currency began to fall, and during the day it continued. What happened? What happened was what we assumed, but did not believe that it could happen. What happened was that around the lows of 2021, the bears did not continue to sell the pair (that is, buy the dollar), so the reaction to the results of the FOMC meeting turned out to be completely the opposite. After it became known about the reduction of the quantitative stimulus program by $ 30 billion per month and the Fed's desire to complete the program completely in March 2022, the dollar rose slightly by 40 points. And, from our point of view, it was logical. And this movement had to continue, as the Fed once again showed its "hawkish" attitude. But, as mentioned above, this did not happen. And this did not happen solely for technical reasons. In addition to reducing QE and the increased likelihood of a rate hike already in March 2022, it became known that all members of the FOMC already support several tightening next year. Jerome Powell also noted the high pace of recovery of the labor market and said that he and the economy no longer need stimulation in the previous volumes. Based on all this, we conclude that there was not a single reason for the growth of the European currency. From a technical point of view, the pair spent most of yesterday in the same side-channel as before. Namely, between the levels of 1.1230 and 1.1353. It was from the first that it pushed off on Wednesday evening, and by the second it grew during Thursday. Thus, last night it was possible to conclude the preservation of the flat. And this is after two meetings of central banks. Thus, at the moment, the technical picture has not changed much. We can only say that the US dollar did not use its chance to continue growing.

The European Central Bank did not surprise the markets with anything.

We have dealt with the Fed, but what about the ECB? Much less was expected from the meeting of the European Central Bank. There were no prerequisites for the European regulator to suddenly raise the key rate or announce the early termination of the PEPP program. Thus, the only thing that can be noted after the ECB meeting is a decrease in the pace of asset purchases in the first quarter of 2022, as well as plans for the full completion of the program in March 2022. In addition, the bank said it would continue to reinvest funds from redeemable bonds at least until the end of 2024. The ECB Governing Council expects that rates will remain at zero or lower until inflation reaches 2% and will not persist at this level until the end of the entire forecast period. After this information became known, the European currency continued to strengthen. Although there were no special reasons for that, again. It has been known for a long time that the PEPP program will be completed in March, and the regulator reduced the pace of asset purchases in the third and fourth quarters of 2021. Therefore, there were no special results of the meeting.

In general, it can be stated that both meetings were held as expected from them. The Fed took the path of gradual tightening, the ECB took a wait-and-see, passive position. Consequently, unless the markets have already fully worked out all the factors of the dollar's growth, the US currency will resume its growth against the euro. However, we have already warned that the US currency has been growing for quite a long time, so traders could already get enough of its purchases. If so, then a new upward trend for the pair may begin now.

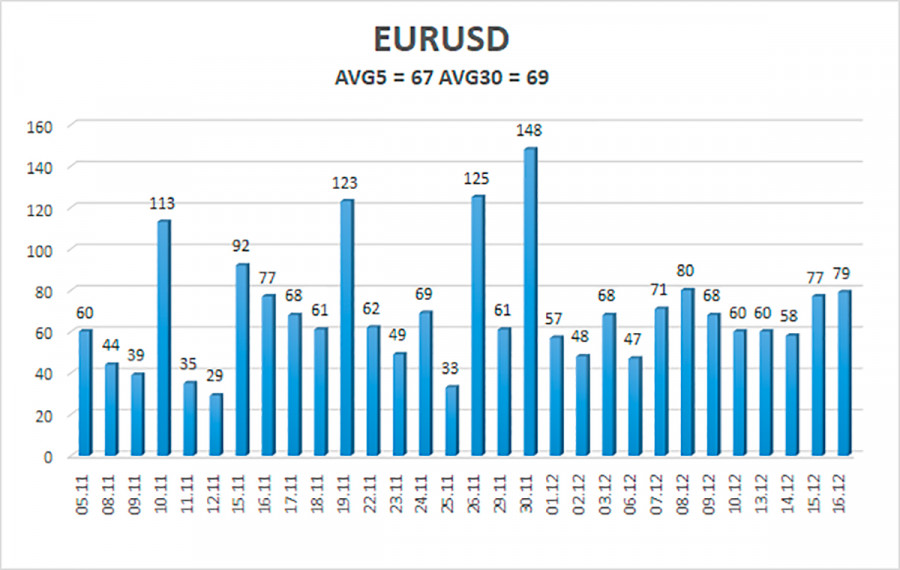

The volatility of the euro/dollar currency pair as of December 17 is 67 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1241 and 1.1376. The reversal of the Heiken Ashi indicator downwards signals a round of downward movement in the same side-channel 1.1230-1.1353.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230-1.1353 side channel. Thus, you can continue to trade for a rebound from the upper or lower border of this channel or for fixing below/above the moving average with the goal of the nearest border of the channel.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.