Bitcoin takes a break after setting a historic record and tries to gain a foothold in a safe zone on the local support line. However, even if the cryptocurrency breaks through $63k, then the nearest support zone around $60k will keep the coin afloat, which will allow investors to buy more, and the price can safely move to new highs. Over the past few days, another fundamental reason for the growth of bitcoin quotes has come to the fore, which has become especially aggravated with the start of the next wave of coronavirus in the world. We are talking about inflation, and JPMorgan experts are sure that it is precisely the fear of this index that spurred global capital to new investments in Bitcoin.

However, the current BTC buying cycle differs from previous ones with a significant expansion of the audience. The main revelation was the confession of the former speaker of the House of Representatives Newt Gingrich, who said that the central banks of the countries have long kept the first cryptocurrency (BTC) as a reserve and protection against inflation. This statement suggests that all statements by regulators about a possible ban and tight regulation of BTC are speculation. In addition, it became known that the pension fund the Houston Firefighters' Relief and Retirement Fund (HFRRF) invested in Bitcoin and ETH. Previously, investments of such large institutions in the crypto market were not recorded, which is a turning point in terms of bitcoin recognition. Back in the middle of spring 2021, leading analysts admitted that if all US pension funds invest at least 1% in BTC, then the capitalization of the first cryptocurrency will increase 50 times.

Most likely, the coronavirus crisis and the pace of inflation have forced public financial institutions to seek refuge in a more risky but profitable investment, like BTC. However, the final chord, which became a kind of signal for institutions (private and public), was the statement by the head of the Fed and the director of the SEC about the absence of plans to ban cryptocurrencies in the United States. The subsequent approval of ETF funds confirmed America's intention to become a major investment hub in cryptocurrencies. Given the growing dynamics of changes in the institutional audience, it is likely that more and more large government funds will start using BTC as a hedge of risks, and the coronavirus will only accelerate this process.

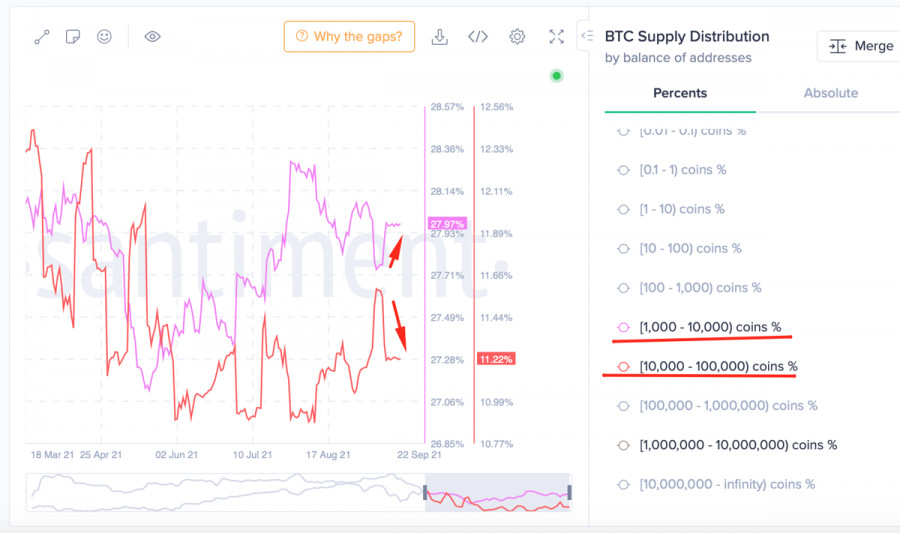

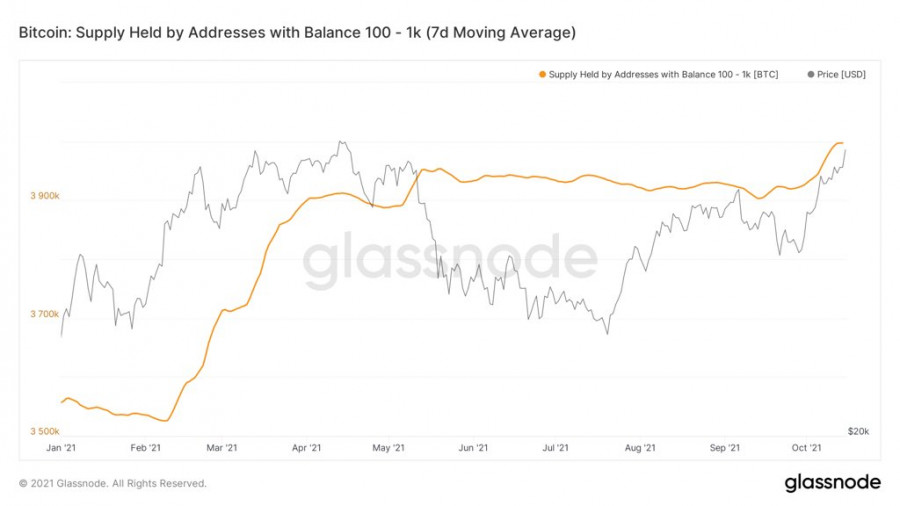

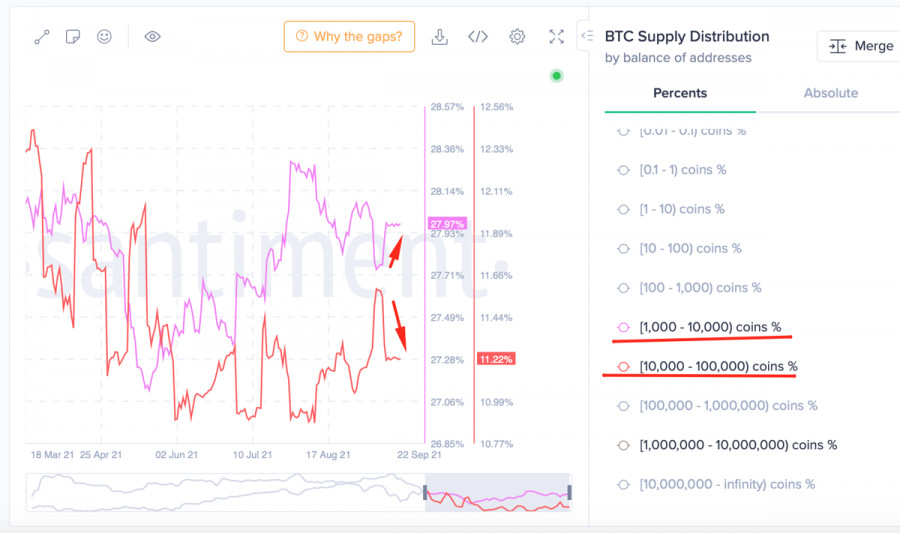

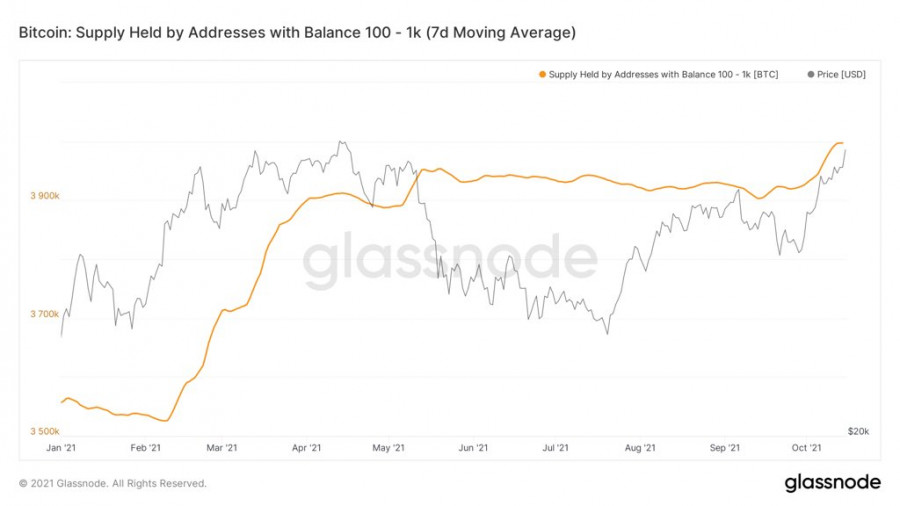

The growth in the number of institutional investors continues to break records, and companies accumulate volumes of coins. The main engines of the bullish rally are still the whales that have accumulated BTC since February 2021. In October, the indicator again made a powerful leap upward and set a new record for the influx of institutional investors. Interestingly enough, the on-chain charts show a serious decline from addresses accumulating from 10k to 100k BTC.

During this time period, the audience owning from 1,000 to 10k BTC, on the contrary, began to acquire more coins. This indicates that the volume on the exchange is created not only by retailers but also by part of big capital. Despite this, there is a balance sheet according to which part of the assets being sold are immediately absorbed by other categories of large investors. Taking into account the achievement of a historical maximum among the activity of 1k-10k BTC addresses, we should expect a new bullish spurt from Bitcoin.

Despite the formation of a bearish engulfing candlestick, Bitcoin indicators on the daily chart continue to signal continued growth. At the same time, locally, the indicators show weakness: for example, the MACD has formed a downward bar of momentum, which may mean a decrease in the upward short-term bullish momentum. The Relative Strength Index and the Stochastic Oscillator are still holding above the 60 mark, which indicates that the bullish momentum remains in the medium-term dynamics. However, selling pressure, reinforced by profit-taking, continues to push prices down. In addition, the number of sell orders began to increase since Thursday evening, and the formation of a bearish candle only exacerbated the local decline in BTC/USD.

It looks like the buyer's market is ready for a price cut for buying with medium-term prospects, and therefore, most likely, the asset's quotes may drop to the key support zone at $59.7k, after which the bulls will begin to act. And despite the local weakening, the growing percentage of institutions and their diversity over the past two months suggests that the market is set for an upward trend, and therefore the coin will complete stabilization over the weekend, and bitcoin will resume growth by the beginning of next week. Among the immediate targets of the coin, it is worth highlighting the $67.7k, $70k, and $93k marks as the main target according to the S2F model.