To open long positions on EUR/USD, you need:

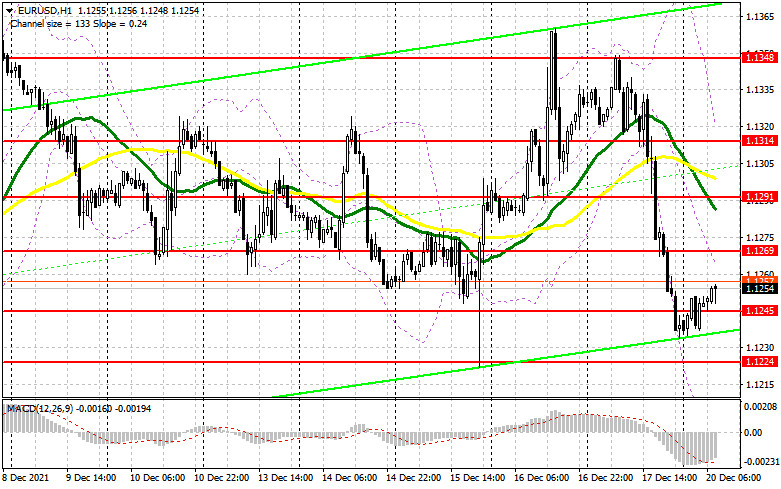

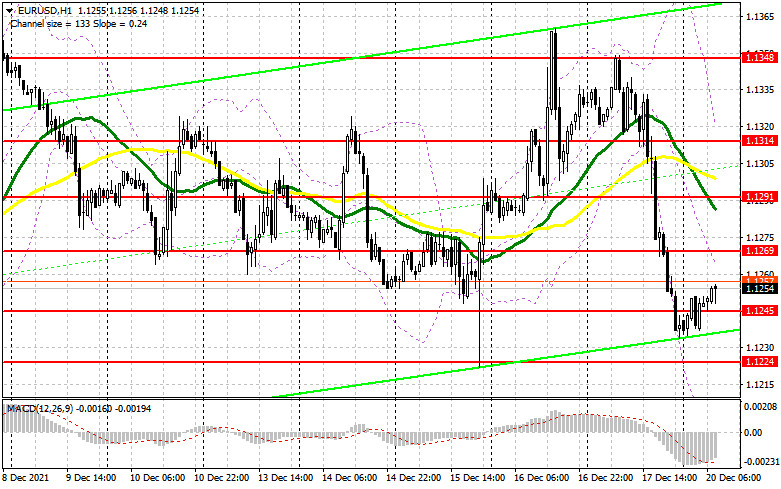

The euro sharply fell against the US dollar on Friday. Let's take a look at the 5-minute chart and understand the points of entry into the market. In my morning forecast, I paid attention to the 1.1321 level and advised you to make decisions on entering the market. The decline in the German IFO indices and the lack of inflation growth in the eurozone in November this year did not allow the European currency to continue its bullish momentum in the first half of the day, which was observed yesterday. However, with all this, the bulls managed to protect the support of 1.1321. Forming a false breakout there led to a good signal to open long positions. At the time of writing, the pair went up 20 points and that was the end of it. The pressure on the euro sharply increased in the afternoon. A breakthrough and a reverse test from the bottom up of the 1.1321 level provided an entry point into short positions. As a result, the pair collapsed by more than 90 points, crossing out all the growth observed after the European Central Bank meeting. And what were the entry points for the pound this morning?

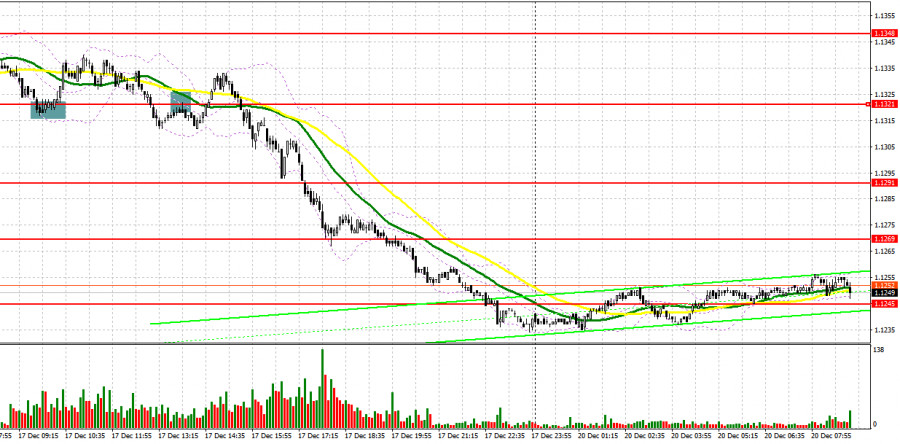

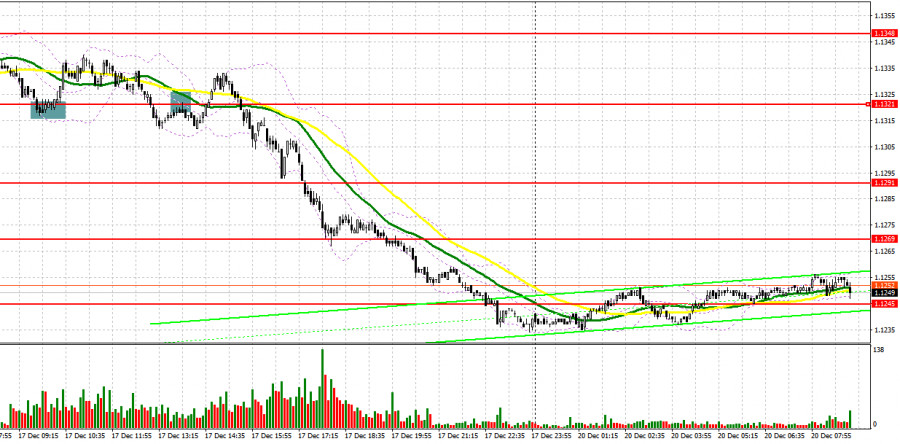

There are no important statistics today, so the pressure on the euro will continue in the future. The fact that trading is taking place near the lower border of the wide horizontal channel from November 30 creates a number of serious problems for euro bulls. Weak data on the current account balance of the ECB's balance of payments in the euro area will not have a serious impact on the euro, but may push to build up short positions in the pair. Bulls need to make every effort to protect the 1.1245 interim support. Forming a false breakout there will be a signal to buy the euro against the bear market observed last Friday. An equally important task is to return to a rather important resistance at 1.1269. Its breakthrough and reverse test from top to bottom will open the opportunity for growth to the 1.1291 area, where the moving averages, playing on the bears' side, pass. A more distant target is the 1.1315 level, where I recommend taking profits. If the pair declines during the European session and the bulls are not active at 1.1245, it is best to postpone buying until the larger support at 1.1224 - the bulls' last hope to keep the pair in a horizontal channel. I advise you to buy EUR/USD immediately on a rebound from the 1.1208 low, or even lower - around 1.1188, counting on an upward correction of 20-25 points within the day.

To open short positions on EUR/USD, you need:

Bears have made a very serious statement about themselves. Today's disappointing performance in the euro area is likely to return pressure on the euro, which will lead to another wave of decline in the pair. The bears' main task in the first half of the day is to protect the 1.1269 level. Forming a false breakout there, together with the weak report of the German Bundesbank on the economy, creates the first entry point to short positions, counting on the preservation of pressure on the pair and a decrease in the area of the lower border of the horizontal channel at 1.1224. A breakthrough and a bottom-up test of the intermediate support at 1.1245 will lead to another signal to open short positions with the prospect of a decline to the 1.1224 area. Only a breakthrough of this level will take down a number of bulls' stop orders and cause a larger fall in the pair with the resumption of the bearish trend towards 1.1208 and 1.1188. A more distant target is the 1.1155 level, where I recommend taking profits. If the euro grows and the bears are not active at 1.1269, it is best not to rush to sell. The optimal scenario will be short positions when a false breakout is formed in the 1.1291 area - there are moving averages playing on the side of the bears. Selling EUR/USD immediately on a rebound is possible from the highs: 1.1315 and 1.1348, counting on a downward correction of 15-20 points.

I recommend for review:

The Commitment of Traders (COT) report for December 7 revealed that short positions decreased and long ones slightly increased, which led to a decrease in the negative delta value. Many traders have been preparing for the central bank meetings this week. Very serious changes are expected in the monetary policy of the Federal Reserve, as well as the European Central Bank. The inflation data is forcing the management to act more aggressively, but knowing which path it will take is rather difficult. Last week, there were several speeches by Fed Chairman Jerome Powell, who in his comments talked enough about the expected changes in monetary policy towards tightening. The Omicron coronavirus strain is also keeping Europeans and Americans awake, dampening demand for risky assets amid uncertainty over the ECB's future policy. The latest November COT report indicated that long non-commercial positions rose from 191,048 to 194,869, while short non-commercials fell from 214,288 to 203,168. important events in the conditions of the formed horizontal channel. At the end of the week, the total non-commercial net position decreased its negative value from -23,240 to -8,299. The weekly closing price, on the contrary, did not change due to the horizontal channel - 1.1283 against 1.1292.

Indicator signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates the bears' return to the market .

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, support will be provided by the lower border of the indicator at 1.1208. In case of growth, the upper border of the indicator at 1.1315 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.