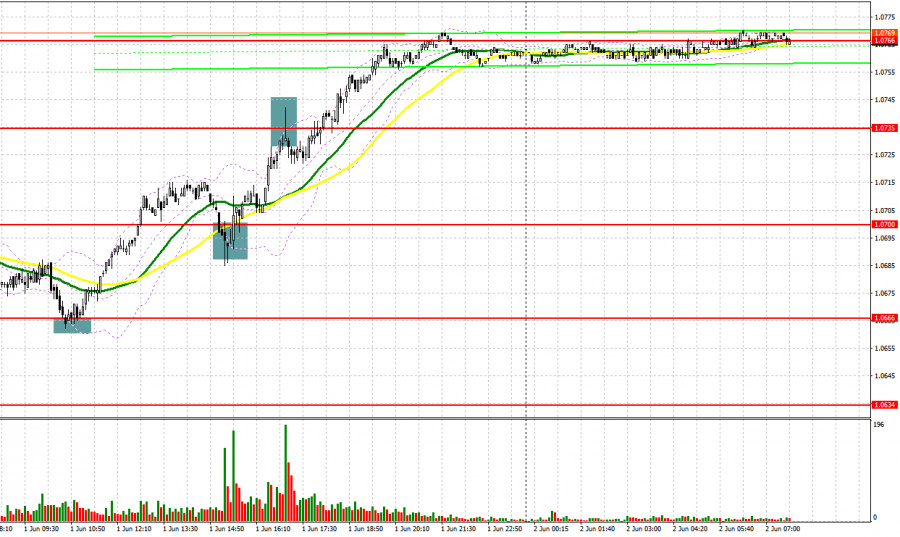

Yesterday, there were several entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.0666 and recommended making decisions with this level in focus. A decline and a false breakout of this level gave an excellent entry point into long positions, which resulted in an upward movement by more than 40 pips. In the afternoon, the pair fell after the resale of the US labor market data. However, the bulls managed to protect 1.0700, giving another buy signal with a rise of 35 pips. Short positions from 1.0735 did not bring the expected result.

When to open long positions on EURUSD:

A drop in the US ISM Manufacturing Index adversely affected the US dollar yesterday. Today traders are anticipating the US unemployment rate. The reading is projected to rise. Apart from that, the NonFarm Payrolls are on tap. A softer indicator will trigger a decline in the US dollar. It will indicate that the Fed could take a pause in monetary tightening this month. A fall in the average hourly wage may also lead to a decrease in the US dollar against the euro.

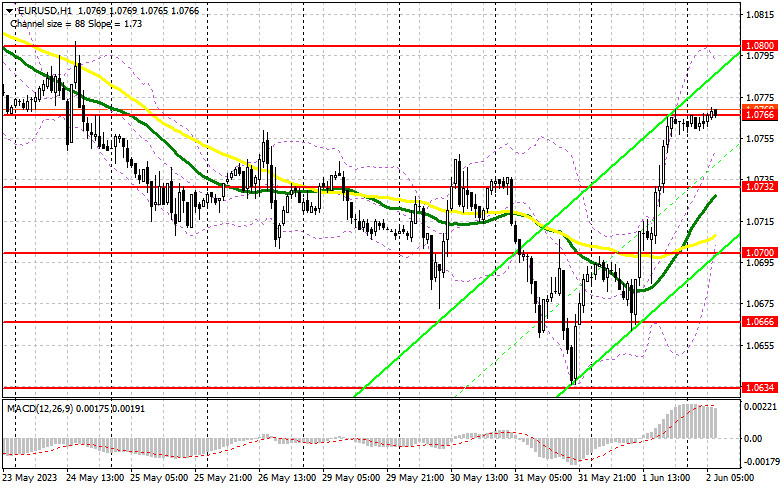

Given that how high the pair climbed by the end of the week, it is better to go long only after a decline and a false breakout of the support level of 1.0732 formed yesterday. Positive NFP data will create new entry points into long positions from this level. The target level will be the resistance level of 1.0766 where trading is carried out now. A breakout and a downward retest of 1.0766 in the afternoon will boost demand for the euro by providing an additional entry point into long positions with a jump to a high of 1.0800. A more distant target will be the 1.0833 level where I recommend locking in profits.

If EUR/USD declines and bulls fail to defend 1.0732, which is quite likely in the case of strong NFP data, pressure on the pair will return. Therefore, only a false breakout of the support level of 1.0700, where the moving averages are passing in the positive territory, will give new entry points in long positions. You could buy EUR/USD at a bounce from 1.0666, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EURUSD:

Bears are in no hurry to return to the market, especially amid positive news and weak data on the US ISM Manufacturing Index. I would not advise you to rush with short positions. Only the protection of the resistance level of 1.0800 will create a sell signal. Given that there is no data from the eurozone today, the euro is likely to continue its recovery. A false breakout of 1.0800 could give a sell signal that may push the pair to 1.0766. Consolidation below this level as well as an upward retest could trigger a drop to 1.0732. A more distant target will be the low of 1.0700. The pair could test this level only if the unemployment rate in the United States decreases. I recommend locking in profits there. If EUR/USD rises during the European session and bears fail to protect 1.0800, it would be better to postpone short positions until a false breakout of the resistance level of 1.0833. You could sell EUR/USD at a bounce from 1.0870, keeping in mind a downward intraday correction of 30-35 pips.

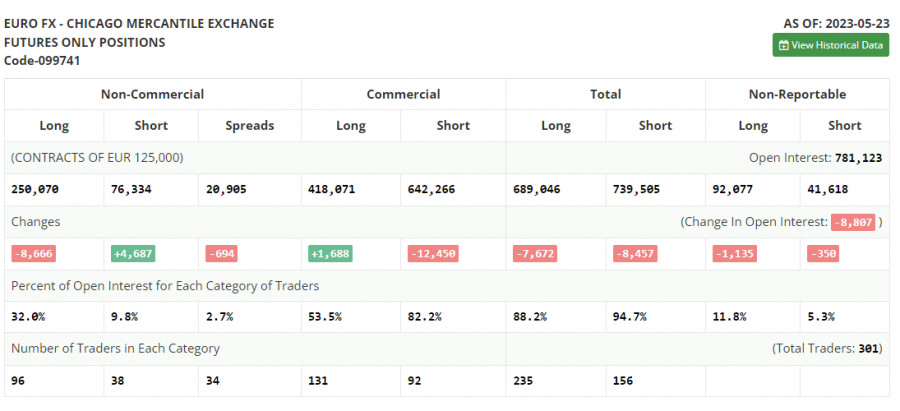

COT report

The COT report for May 23 logged a reduction in long positions and an increase in short positions. The decline in the euro continued as the debt situation had not yet been resolved, and the risks of a more severe recession in the US remained. However, even after the news of reaching an agreement and avoiding a US default, the US dollar continued to be in demand. The latest inflation data confirmed the need for further rate hikes by the Federal Reserve, so investors are no longer counting on a summer lull. The COT report indicates that non-commercial long positions decreased by 8,666 to 250,070, while non-commercial short positions jumped by 4,687 to 76,334. As a result, the total non-commercial net position increased to 185,045 from 187,089. The weekly closing price declined to 1.0793 from 1.0889.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates a further upward movement.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0700 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.